Germany

At the core of the German welfare benefits system is the comprehensive social insurance system into which most workers pay, which includes healthcare provision, unemployment insurance and pension insurance. Once you pay into all these parts of the system, (about 15.5% of your salary for healthcare, 3% for employment insurance, nursing care insurance, 2.2% or 1.95% for those with no children, 18.9% for pension insurance – most of these shared with an employer) you are entitled to a range of benefits, including healthcare for older people. Prescriptions and glasses are covered by that system so don’t have to be applied for separately, and are not classed as benefits.

The normal retirement age for everyone born after 1964 is 67 years. Women who take time off to have children have their contributions topped up by the state. But an OECD report published this week shows that Germany has the widest pension benefits gap between men and women in Europe and the US. The average monthly pension received is around €1,052 (£767.46) for men in the old West German states, and €1,006 (£733.9) for those in the old East German states, while for women the figures are €521 (£380) and €705 (£514). Kate Connolly, Berlin

Japan

Roughly one in four Japanese are 65 or over – that proportion is expected to rise to one in three by 2025. Pride that life expectancies for Japanese men and women are among the highest in the world is tempered by concern over how to pay for welfare in the coming decades, when there will be fewer people of working age to foot the bill. In 2012, the full basic pension was ¥786,500 (£4,342) a year, 16% of average earnings of 4.79 million yen (£26,443) a year, according to OECD figures. Everyone aged between 20 and 59 is expected to enrol in the basic national pension scheme, but only those who have paid in for a minimum of 25 years are eligible to draw a pension when they retire at 65. Full-time company employees and their spouses are automatically included in the employees’ pension scheme, which provides additional contributions to the basic state pension, proportional to an individual’s salary. The government estimates that about 85% of Japan’s workforce draw from the employees’ pension scheme. The fuel allowances for low-income residents will be cut by about ¥3bn (£16.2m) in this financial year. People aged 75 or older only need to shoulder 10% of their medical costs unless they have a high income. Everyone else pays 30% of the total cost. Some cities offer reasonably priced annual passes that enable elderly passengers unlimited travel for a year. Justin McCurry and Chie Matsumoto, Tokyo

Nordic countries

Unlike Sweden and Finland, in Norway pensions are holding up, and poverty among pensioners is actually falling dramatically, despite rising average wages. The official pension age has been 67 for both men and women since the 1970s, but it is possible to draw a full old-age pension from 62 and continue to work full time, while there is a range of options to draw a partial pension. But 67 remains the age when most people aim to retire – and the age at which people on disability benefits are transfered to pensions. Norwegians can continue to accrue pension entitlement until they are 75. Norway’s pension system is in transition, and currently two versions are in operation as the old one is phased out. The outgoing one is a defined benefit scheme comprised of a flat-rate universal benefit, an earnings-related second tier and a minimum benefit floor of almost 50% of average earnings after tax. It is a strongly progressive, egalitarian system due to the comparatively generous level of minimum protection and a decreasing replacement rate for earnings above the average annual wage. Marginal tax rates on pension income rise rapidly. A worker in Norway with 40 years’ contributions on an average wage can expect to enjoy a pension of about 67% of their previous income after tax. A new system is gradually taking over that consists of a defined contribution scheme, plus a minimum guaranteed pension. The payouts from this scheme are subject to a life expectancy adjustment, implying that old-age benefits for each new cohort of pensioners will be reduced in proportion to increases in longevity compared to 2010. Employment among older people is high in Norway, with more than 70% of people aged between 55 and 64 still working – well above the EU average of around 50%. In Sweden, pensions used to be more generous than in Norway, but the average pension is now just above 50% of wages, and it is expected to dip below that level if life expectancy increases and the retirement age is not postponed. The guaranteed minimum pension is about one-third of the net average wage. Pensioners in Sweden and Norway get discounts on public transport, entry to museums and an income-tested housing allowance is available. Pensioners – like other people in need – can also apply for social assistance to cover one-off payments and special needs. David Crouch, Gothenburg

Russia

The legal retirement age in Russia is early by European standards: 60 years for men and 55 for women. There has long been talk of raising the age, but given that male life expectancy is only just above 60, the move would be deeply unpopular. Russia’s finance minister said in a recent interview that the pension age should be increased gradually until it is 63 for both men and women. There is also talk of introducing an income test for pensioners – currently none exists and working pensioners or those receiving money from investments or other sources can still claim their pension. Workers involved in certain categories of hard labour, those who have spent more than 15 years working in Russia’s far north, and mothers of more than five children, are entitled to begin receiving their pensions earlier. A new points-based system is being phased in that will determine how much money pensioners receive based on how many years they worked. Currently, the basic state pension is around 4,000 (£40) roubles per month, but almost all pensioners receive a number of add-ons, and the average pension across the country is around 11,000 roubles (£110) per month, which is a little under one-third of the average salary. Some regions have particular allowances, for instance pensioners who have been registered living in Moscow for more than 10 years have their pensions topped up to at least 12,000 roubles by the Moscow city government.Pensioners also have a number of travel subsidies, discounted medicine, as well as small savings in certain supermarket chains, usually offered on particular days of the week. There is no guarantee of the security of Russia’s pension fund further down the line, and indeed it was recently admitted that 243bn roubles (£2.4bn) had been redirected from the pension fund to pay for costs associated with annexing Crimea. Shaun Walker, Moscow

United States

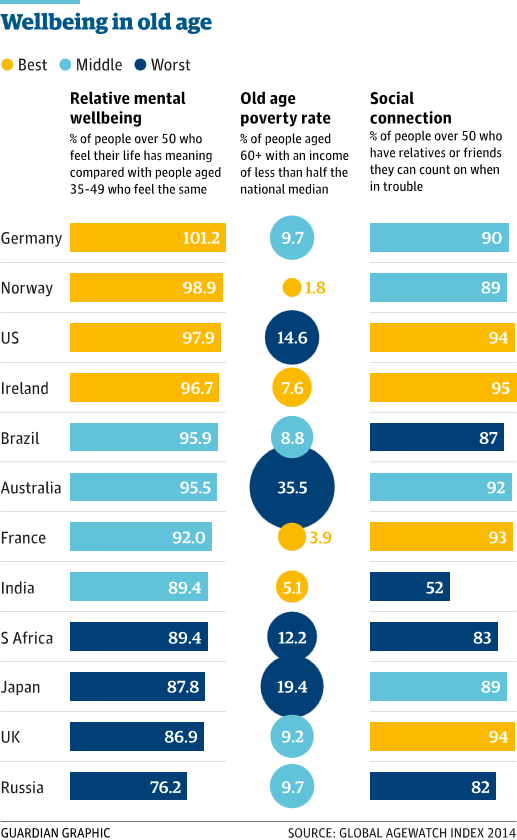

As the country ages there is no shortage of local, state, national and not-for-profit initiatives that cater to older citizens’ needs. From prevention of elder abuse to ageing awareness to help with nutrition, assistance programmes are a common feature in many communities. Take the “Campus Kitchens Project”, which along with the older persons’ organisation, AARP Foundation announced in 2014 a three-year renewal of its outreach effortsusing student volunteers to combat hunger and isolation among older people. With an estimated 9m older Americans at risk of hunger and the number of hungry people over 50 up by 80% in a decade the initiative harnesses a number of student-run kitchens at colleges across the country to help tackle food insecurity. Meanwhile in Pennsylvania, one project, “Coming of age”, under the auspices of a collection of organisations, including the state branch of AARP has trained administrators in methods to revamp “seniors centres” to make them more appealing for older people to spend time in with numerous benefits including reducing social isolation. While there are plenty of examples of inventive community-based initiatives, there are wider challenges not least of which is funding retirement. Exactly what income and benefits an individual receives when they reach 65 depends on a host of factors including which state they live in, whether they continue working past retirement age and in what capacity, the level of private or public sector employment-based pensions and other savings or investments. The Pension Rights Center in Washington DC and the Pension Policy Center report that of the 44.7 million Americans over the age of 65 in 2013, half had a total annual income of less than $20,380 (£13,271) – from all sources. Most US retirees receive income from social security, a federal social insurance programme to which people contribute via direct taxation. In the absence of a national state pension, it is the primary source of income for many and widely regarded as the foundation of retirement income. In 2013, 85% of older Americans received monthly social security benefits. The average annual benefit from social security for retired workers in 2013 was $15,132 (£9,852). According to the Social Security Administration, the national average wage in the same year was $44,888. For three out of five people over 65 who receive social security benefits it accounts for half of their total annual retirement income but it is particularly important for lower income Americans. In 2012 one in four people over the age of 65 received all of their income from social security. According to the Global Age Watch Index 2014 the modest nature of social security payments and the high reliance on it means that the US has a higher incidence of elder poverty than most other countries One of the most valued public services available to older Americans is Medicare, a national health insurance system with almost universal coverage. According to Global Age Watch the programme provides “good access” to medical services and preventative care. However wWhen it comes to access to services for older people with long-term care needs, however, there are many barriers to obtaining affordable, quality provision because most adults don’t have separate insurance coverage for these. Mary O’Hara, Los Angeles

South Africa

Old age pensions are provided to people above the age of 60 earning below R49,920 (£2,763) if single and R99,840 (£5,527) if married, and whose assets do not exceed R831,600 (£46,041) if single and R1.7 million if married. Beneficiaries must not be maintained or cared for in a state institution, and should not be in receipt of another social grant. An elderly person is typically eligible for a grant of 1,350 rand (£75) per month. Government guidelines state: “It should be noted that social grants for adults are paid on a sliding scale – the more income and applicant has, the less he/she will receive for the grant.” They can turn to extended families and NGOs for help. The services NGOs offer include social support groups, training and education, income generating projects, frail care services, transport to health facilities and luncheon clubs and home based care, according to the Older Person’s Forum. But most of these services are non-existent in rural areas. Nearly three million people were old age pension recipients in 2013/14. There are private companies that offer these benefits to pensioners – such as Specsavers with spectacles and some bus companies regarding travel.South Africa has one of the largest voluntary retirement funding systems in the world (and for the large proportions of people in employment, these arrangements are mandatory conditions of service). There are programmes of support in provincial social department for old age homes.There is broadly free healthcare in public health facilities. Public housing and transport also benefits many elderly people. Those retiring early have their pensions cut by 3.6% for each year, except those forced into early retirement, whose pensions can by cut by a maximum of 10.8%. David Smith, Johannesburg

Italy

The state pension is €219-€230 (£159-£167) per week for people under 80 and €240.30 (£175) for over-80s, depending on Older people, like all other Italians, receive free healthcare under the national health system. The services are either delivered free of charge, or patients pay for them and are reimbursed. Other benefits differ from region to region. For example, residents in Rome over the age of 70 are offered free bus and metro passes. Stephanie Kirchgaessner, Rome

France

The legal retirement age in France now stands at 62 for people born between 1955 and 1973. However a full state pension is only awarded for those who have worked 40-43 years. Those born after 1973 will have to work for 43 years to obtain a full pension at 62. In certain cases, including those who have taken time out for parenting or taking care of a disabled person, it is possible to claim a full pension at the age of 65 (or 67 depending on the date of birth) regardless of how long the individual has worked. For private sector workers, the full pension takes into account the 25 best years worked, with an allowance for inflation, and can total half their monthly salary. Civil servants have a more generous scheme: they can retire on a state pension of 75% of average income, calculated on the basis of their last six months in work (minus bonuses). However under reforms announced last year, civil servants will have to work an extra two years – 43 instead of 41.5 – to receive a full pension, bringing them into line with the work period requirements of the private sector, even though the calculation remains different. For unemployed pensioners, a single person with less than €9,600 (£6,988) per year or a couple with less than €14,904 per year can claim an allowance called the allocation de solidarité aux personnes agés (Aspa), or elderly persons solidarity benefit. In the case of a single person surviving on €7,000 a year, the Aspa allowance would be €2,600 (£1,893) – calculated according to the €9,600 benchmark figure minus the €7,000. A couple with €13,000 would receive €1,904 per year. Anne Penketh, Paris

Ireland

The state pension is €219-€230 (£159-£167) per week for under-80s and €240.30 (£175) for over-80s, depending on social insurance contributions while working, regardless of any income from private or occupational pensions. Pensioners, like those in receipt of long-term social welfare payments or those who can prove they cannot provide their heating needs during winter, are entitled to a means-tested weekly winter fuel allowance of €20 (£ 14.54) per household. Those over 70 receive a free TV licence and in some cases are eligible for means-tested free electricity and gas depending on their fiscal circumstances. All pensioners receive free bus and rail travel, not only in the Irish Republic but across the border in Northern Ireland. Henry McDonald, Dublin Source: The Guardian