Older workers have expertise based on years of experience and make an important contribution to the economy. Photo: James Alcock

I suspect if you were to ask many of those in their late 40s and older if ageism could hold Australia back, their answer would be “yes”. That disappointing view would invariably be based on their personal experiences in the workforce.

Ageism will hold us back because, with an ageing population, we need to increase participation by older workers in the workforce.The evidence over recent decades indicates older people are underemployed for longer periods than younger workers. Australian Bureau of Statistics figures show more than 35 per cent of jobseekers aged 55 and over stopped looking for work because they believed potential employers thought they were too old.

As a society, we are discarding valuable older workers far too early.

These older people excluded from the workforce account for more than half the total number of jobseekers who gave up looking for work.

Older workers face ageist stereotypes and biases, especially in the workplace and in recruitment. These negative attitudes label them as too costly, too inflexible and too difficult to train. As a society, we are discarding valuable older workers far too early.

To safeguard our way of life, we must maintain our incomes and keep people in jobs. In short, we need to keep the economy growing. One of the key drivers of long-term growth is widely recognised as having more people in the workforce.

Unfortunately, if we do not adjust our approach, the long-term outlook for Australia is lower economic growth. Why? Because our population and our economy are changing and that will impact heavily on our workforce participation.

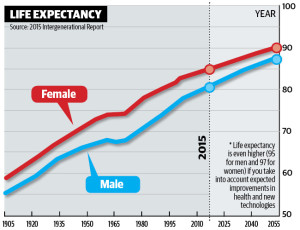

The government will soon launch the 2015 intergenerational report. The report is the most comprehensive examination of demography and current policy. It evaluates how these changes will affect the economy and government finances over the next 40 years.

It will show there will be fewer people of traditional working age as a proportion of the population in the years to come. Over the next decade, the working population is expected to increase by 12 per cent, while the population over 65 is expected to increase by 36 per cent. That is, the number of people aged over 65 will grow three times faster than the traditional working-age population.

The number of people in the traditional workforce supporting those who have left the workforce will nearly halve over the next 40 years.

On the one hand, this a problem, because as the population ages and more people leave the workforce, tax revenues will struggle to fund the same level of government services we enjoy today. On the other hand, this is an opportunity to encourage greater workforce participation, especially among underappreciated and underutilised older people.

We must not fall into the trap of viewing an ageing population as a burden. Older people will be critical to maintaining the economic growth that has underpinned the advances in our standards of living and quality of life.

According to the age discrimination commissioner: “As a society, we have been slow to recognise that millions of older Australians are locked out of the workforce by age discrimination. We are only now starting to understand what a terrible waste of human capital this situation represents; a loss to the national economy and to businesses large and small, and a loss to the individual who is pushed out of the workforce prematurely.”

Deloitte Access Economics estimates a 3 per cent increase in participation by the over 55s would generate a $33 billion annual boost to the national economy. A 5 per cent increase in participation, would see a $48 billion boost to the economy.

If Australia’s workforce participation rate for those aged over 65 increased to that of New Zealand over the next 10 years, this would result in a boost to Australia’s real gross domestic product of about $40 billion in 2024-25.

Older workers contribute knowledge and skills based on years of experience and expertise. We need older people working and contributing to our economic growth.

Also, people who work longer accrue more superannuation savings and are less reliant on the pension during retirement.

There is a strong correlation between workforce participation and health status. Continuing to work protects against physical ill-health and poor mental health. Data shows people staying in the workforce past retirement age tend to have better health compared with those not working.

Older workers also report the need for flexibility in their working hours or part-time arrangements so they can fit in caring responsibilities or manage sickness or disability.

The decline in participation rates of older workers only aggravates the problem of age dependency and rising social expenditures. Ignoring a pool of productive workers in the face of a falling participation rate will affect our economic growth.

If these trends continue, we as a society will be contributing to a decline in our standard of living. So let’s reverse the traditional attitudes, embrace a longer life and look for ways to redesign our lives so we can enjoy prosperity along the way.

Joe Hockey is the federal Treasurer.